Energy Reliability

Reward Weightings

The reward adjustments for cleaner energy will help improve the reliability of energy networks.

— Dr. Delton Chen (Founder)

Contents

Introduction

Stakeholders will also be involved in the GCR policy by helping to determine the “reward adjustments” for energy reliability. Reward adjustments are a secondary/optional price signal that will be used to incentivise energy companies to manage their cleaner energy in ways that improves the reliability of energy networks. The intention is to minimise disruptions to energy supply-chains and incompatibilities across energy networks.

The reward adjustments for energy reliability can be applied to any energy commodity, including liquids, solids, gases, nuclear, electricity, biofuels, wind, solar, and any kind of energy storage system. The reward rules and reward adjustments can be applied to primary and secondary energy commodities. For example, the reward rules and reward adjustments can be applied to natural gas, and then again to electricity that is generated from natural gas.

Stakeholder Groups

The proposal is to create an Internet portal for stakeholder groups through which stakeholders can register their design preferences (i.e. their ranked criteria) in relation to the quality of energy, and the design and management of networks for delivering that energy. The Internet portal will be used to achieve a statistical consensus on the ranked criteria. The organisation of the stakeholder groups will be guided and overseen by the rewarding authority. It is proposed here that the stakeholder groups should be established in collaboration with regulators, energy associations, institutions, research groups, service companies, industry groups, and consumer associations. The establishment of these stakeholder groups will be voluntary and their operation will be transparent.

Energy institutions and design standards for addressing energy issues already exist. However, in a rapidly evolving market for cleaner energy there may be competing ideas and a need for trade-offs. The ranked design criteria of the stakeholder groups will be used to score each cleaner energy company so that their reward adjustments (renergy) can be determined (see Eq. 2 & 3 in Reward Weightings). The reward weightings for energy will serve as a price signal that stakeholders can use to influence the decisions of energy investors and energy companies.

The main function of the stakeholder groups for energy reliability is to identify and rank the criteria that should be used to evaluate the quality of cleaner energy in terms of network reliability and consumer needs. The ranked criteria will be placed in the public domain. Energy companies will be expected to take notice of the ranked criteria because their revenue—based on the proposed carbon reward—will be affected by their ability to address the ranked criteria.

The rewarding authority, in conjunction with the stakeholder groups, will evaluate the reward adjustments (renergy) for each energy company based on a point scoring system for their cleaner energy commodities (see Eq. 3 in Reward Weightings). The reward adjustments for each energy commodity will sum to zero according to the conservation rule for rewards (see Eq. 4 in Reward Weightings). The reward adjustment for a particular cleaner energy commodity (renergy) will be positive if the energy enhances the reliability of the energy supply network, and conversely the reward adjustment will be negative if it reduces the reliability of the energy supply network. These reward adjustments for energy reliability may be combined with the adjustments for community wellbeing and ecosystem health, to produce a net adjustment (r) and a final reward weighting (w) for each energy company (see Eq. 1 & Eq. 2 in Reward Weightings).

Certain energy markets will tend to be global (e.g. the oil trade), and others will be divided into geographic regions (e.g. grid electricity). Yet others will be divided into political regions (e.g. uranium). It is suggested here that the stakeholder groups for each energy commodity should be allowed to divide into sub-groups to match the inherent divisions of their energy market. The main implication is that the evaluation of the reward weightings will be made more granular with the emergence of sub-groups. The presence of stakeholder sub-groups does not fundamentally change the policy, because the resulting reward adjustments should always sum to zero for each stakeholder sub-group and parent stakeholder group.

Five Steps for Adjusting Rewards

Step 1. Energy experts will be invited to establish stakeholder groups on a voluntary basis, and with each group being responsible for one kind of energy commodity. The stakeholder groups may divide into sub-groups if the energy market is inherently divided.

Step 2. Individuals within each stakeholder group or sub-group will define and rank their design criteria for the reliable supply of cleaner energy.

Step 3. A consensus will be found for each stakeholder group or sub-group in relation to the ranked design criteria for evaluating cleaner energy projects.

Step 4. The ranked design criteria will be used to create a subjective point scoring system for evaluating each cleaner energy project or company.

Step 5. Subjective scores will be assigned to each cleaner energy project or company, and from these scores the reward adjustments will be calculated (see Eq. 2 to Eq. 4 in the section on Reward Weightings).

The cost of administering the stakeholder groups and the reward assessments will be covered by an administrative fee. The fee will be charged to the energy companies that receive the carbon reward. The stakeholder groups for energy will be involved in ranking health, safety and environmental issues, but only from a standardised perspective. They won’t be involved in assessing the wellbeing of individual communities or the health of individual ecosystems. These issues will be addressed by other stakeholder groups, as explained in the section on Reward Weightings.

The stakeholder groups are not a substitute for government regulations and direct public investment. The reward adjustments for energy reliability (renergy) should only act as a complement to existing regulatory frameworks, because the reward policy is not designed to force decisions on energy companies. There will be no legal requirement for energy companies to comply with the wishes of stakeholder groups. The energy companies should be interested in the advice of the stakeholder groups because this advice will impact on their reward earnings and public image. The stakeholder groups for energy reliability will not be involved in judging whether energy prices are too low or too high, however there may exist some correlation between energy reliability and energy prices.

Example: Hydrogen Fuel Reliability

Important Policy Note: The feasibility of green hydrogen to accelerate the clean energy transition is a politically contentious issue. This is also true for certain other technologies, such as carbon capture and storage (CCS) and direct air capture (DAC). The GCR does not subsidise the development of any energy technology. The GCR is a financial reward that will only be paid for tangible climate mitigation benefits, regardless of the type of energy or the technology that is used. In this respect, the GCR is technology agnostic. Energy companies will be required to raise the financial capital that they need to build the new infrastructure. The GCR helps these companies by providing a guaranteed revenue stream that can be used to justify the high cost of the infrastructure that will be needed for a clean energy transition.

1. Background

Grey/brown hydrogen is mostly generated from natural gas via steam methane reforming. Blue hydrogen is made from natural gas and carbon capture utilisation and storage (CCUS). The price of grey/brown and blue hydrogen is influenced by natural gas prices and the cost of CCUS. A new technique of producing blue hydrogen from fossil energy was developed recently, called underground steam reforming.

Green hydrogen is produced from renewable energy sources and hydrolysis but only a small amount of green hydrogen is currently produced because of the high cost. Prices for green hydrogen are expected to fall as production capacity grows, and as the cost of renewable energy falls. Some people envision that green hydrogen will be produced for export by countries that have abundant renewable energy resources. A method of converting (green) ammonia into hydrogen, using a metal membrane, was recently developed, and this new technology may improve the economics of bulk hydrogen transport.

Technologies that can utilise hydrogen are also important. For example, the Hydrogen Energy Release Optimizer (HERO) is a catalyst that can convert hydrogen and oxygen into heat and water without combustion, and at high thermal efficiency. HERO can be used to produce high temperature steam for power stations and industrial processes. It may also be possible to blend some hydrogen with natural gas for supplying conventional gas grids.

Green hydrogen can be produced from seawater by separating the hydrogen and oxygen of water molecules via electrolysis. Some experts believe that converting hydrogen to/from ammonia is the ‘missing link’ of the international hydrogen market.

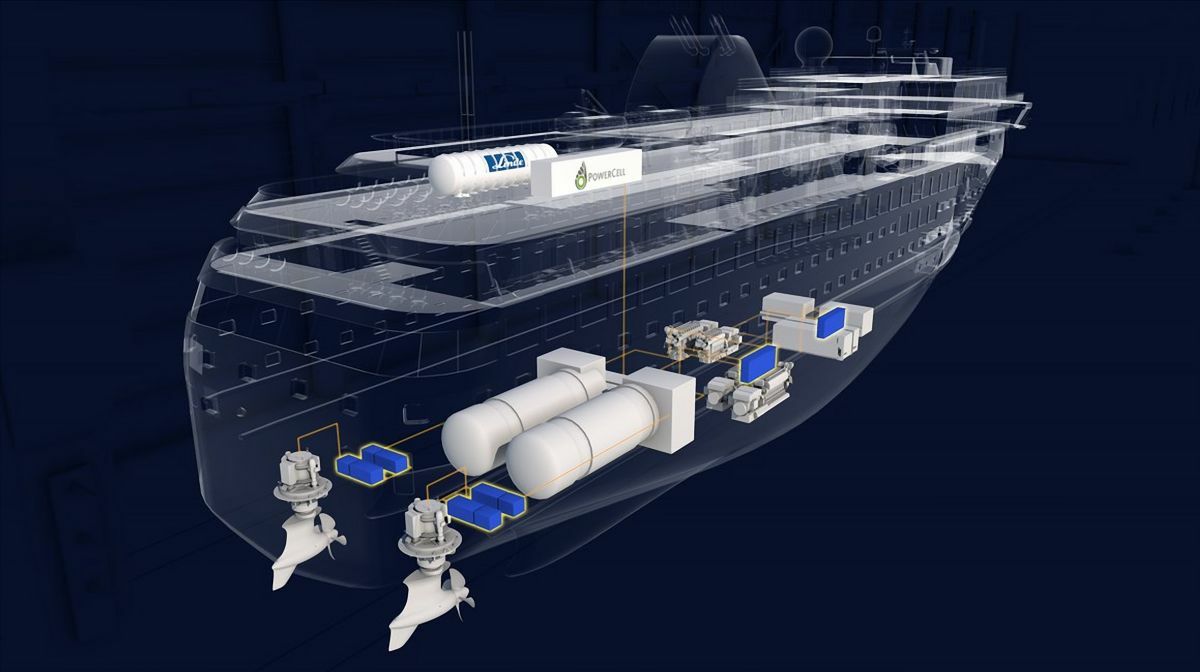

The International Council on Clean Transportation (ICCT) found that trans-Pacific cargo ships could be powered by hydrogen and fuel cells if only 5% of cargo space is replaced by new fuel systems. Havyard has been commissioned to design a hydrogen powered cargo ship.

2. Reward Storyline 2025-2100

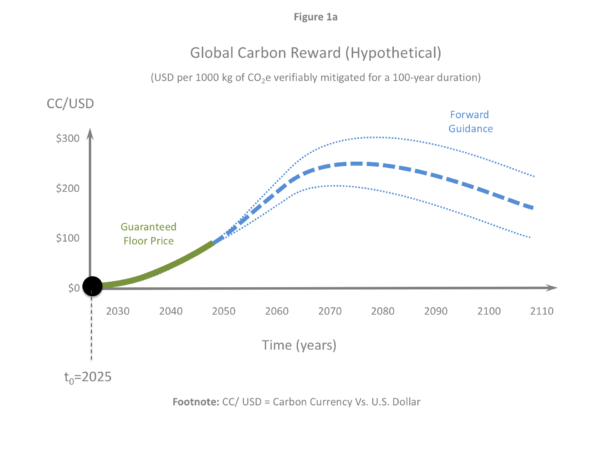

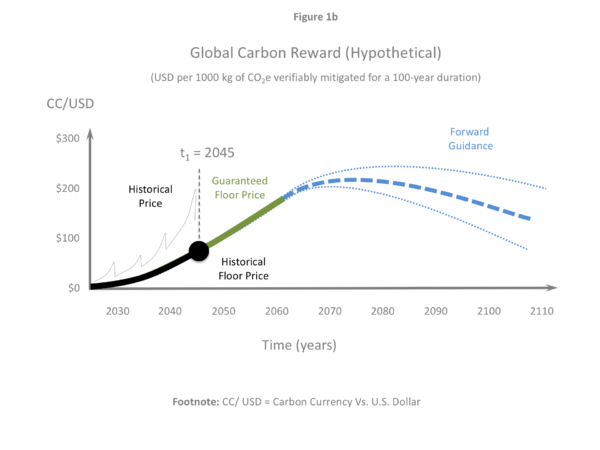

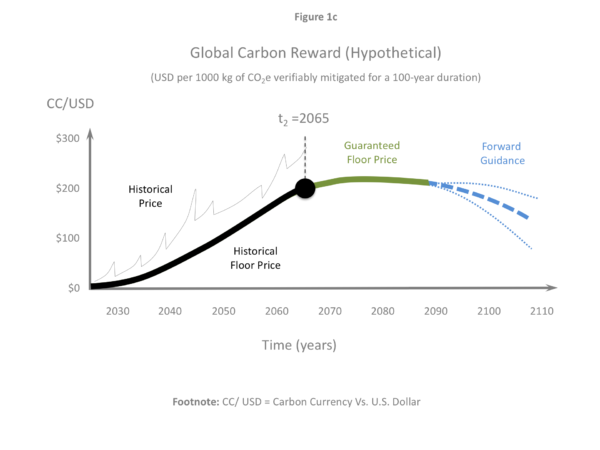

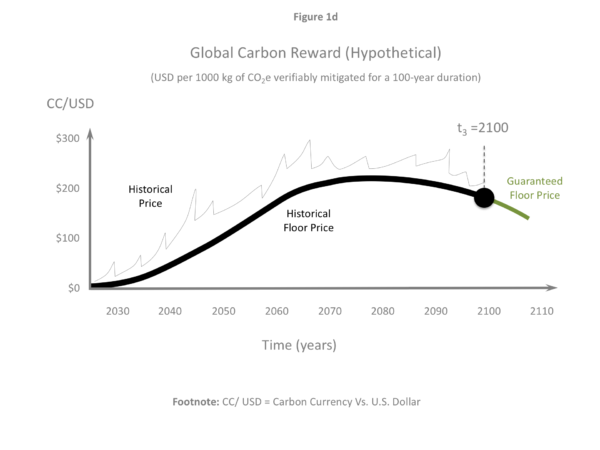

Figure 1 (a, b, c, d).

In the hypothetical storyline for hydrogen fuels, the global reward for mitigated carbon is prescribed, as shown for the years (a) 2025, (b) 2045, (c) 2065, and (d) 2100. These reward price charts are the floor prices for mitigated carbon, and they include a rolling 20-year period of guaranteed prices (solid green lines) followed by forward guidance on prices (dashed blue lines).

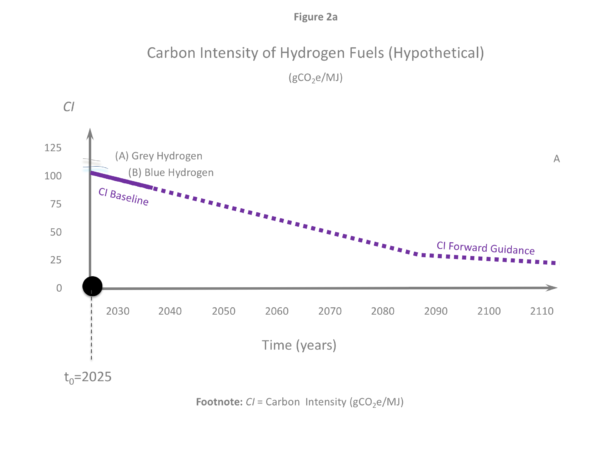

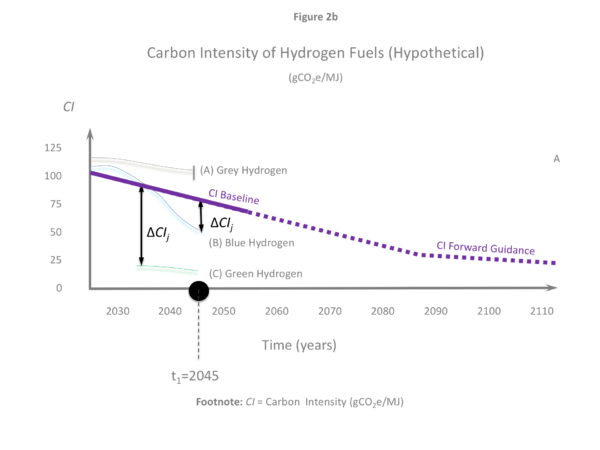

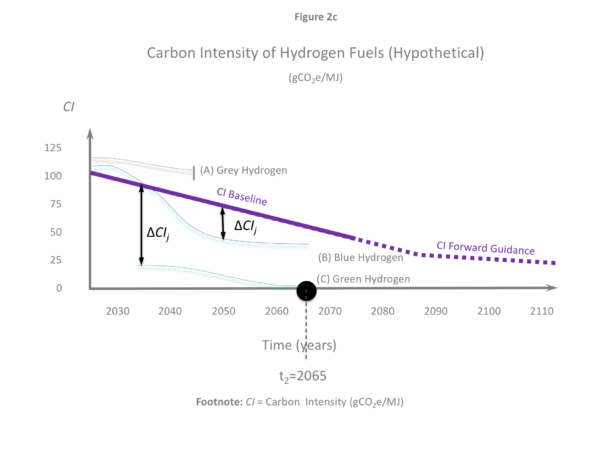

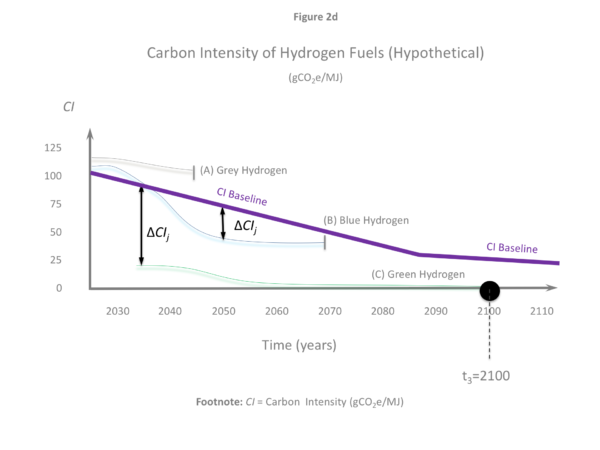

In this hypothetical storyline, the rewarding authority sets the carbon intensity baseline (CIbaseline) for blue and green hydrogen that is sold to consumers (see Figure 2). Figure 2 also shows the average global carbon intensity of grey, blue and green hydrogen that is supplied during the storyline.

The determination of the CIbaseline is subjective, and it is framed by carbon life-cycle analysis and the anticipated cost of hydrogen production. The rewarding authority sets a rolling 10-year CIbaseline guarantee followed by 90-years of forward guidance (see Figure 2). These CIbaseline intensity charts are designed to encourage energy companies to invest in the production of blue and green hydrogen despite the high CAPEX. Grey hydrogen cannot earn the reward because its carbon intensity is higher than the prescribed CIbaseline. The aim of the rewarding authority is to set the CIbaseline to values that are optimal for the rapid and orderly decarbonisation of the hydrogen market.

Energy companies use the information from Figures 1 and 2 to estimate the notional mass of carbon that they can mitigate based on projected future rates of hydrogen fuel production. The notional mass of mitigated carbon is used to estimate the base rewards (R) that will be earned. These future reward payments feed into the financial planning by energy companies.

In the storyline, a few companies are producing blue/green hydrogen prior to 2025. The rewarding authority only rewards these companies if they have plans to significantly expand their blue/green hydrogen production. This is to avoid rent seeking behaviour, and to encourage the expansion of the blue/green hydrogen market. Some energy companies acquire other companies in order to expand their production capacity.

Figure 2 (a, b, c, d).

In this hypothetical storyline for hydrogen fuels, the carbon intensity (CI) baseline is prescribed, as shown for the years (a) 2025, (b) 2045, (c) 2065, and (d) 2100. The baseline carbon intensity is comprised of a rolling 10-year period of guaranteed values (solid purple lines) followed by forward guidance (dotted purple lines). In this hypothetical storyline, grey hydrogen production ends in 2045, and blue hydrogen production ends in 2068, to be replaced by green hydrogen.

The storyline begins in 2025 when most of the hydrogen is grey, and only a small portion is blue or green (see Figure 2). A significant amount of blue and green hydrogen comes online after 2035, after a time delay between new investment and new production. The success of the hydrogen market is also dependent on demand for cleaner energy. This demand is driven by the carbon reward for cleaner business, national commitments to achieve net-zero carbon, carbon taxes, cap-and-trade schemes, and regulatory constraints on heavy and light industries.

The period 2025-2035 is characterised by hundreds of billions of USD-worth of new debt and equity finance, underwritten by future reward earnings. This investment coincides with the rapid development of hydrogen engines for ships, aeroplanes, trains, and trucks, and the retrofitting of heavy and light industries. In this storyline, the supply and the demand for blue/green hydrogen both rise quickly, causing a dramatic fall in the consumption of grey hydrogen and a de-coupling from fossil fuels.

From 2035 to 2050, the carbon intensity of green hydrogen falls significantly with lower-cost renewable energy. By 2045, the grey hydrogen market has completely shut-down. By the year 2068, the green hydrogen market replaces blue hydrogen. Beyond 2068, the carbon reward is still offered for green hydrogen, however the CIbasline continues to fall given the improving economics of hydrogen fuel production.

3. Stakeholder Storyline 2025-2100

The first people to join the stakeholder group are from the Fuel Cell and Hydrogen Energy Association (FCHEA), the International Hydrogen Fuel Cell Association (IHFCA), the World Steel Association (WSA), the International Council on Clean Transport (ICCT), the International Chamber of Shipping (ICS), the International Air Transport Association (IATA), and various other associations that deal with the safety and operation of industrial gases.

The rewarding authority, with the help of the IEA, maintains a register of members and develops the membership rules (refer Step 1). They also set the ratio of members for the public and private sectors, and for countries and regions, to achieve a balance of views. Membership starts at 1,270 people in 2026, and grows to 16,900 by 2045, and 137,000 by 2065.

The activities of the stakeholder group are undertaken through an online portal. The portal also supports webinars, meetings, infographics, presentations, etc. The portal is funded with administrative fees that are charged to the energy companies that earn the carbon reward.

Stakeholders participate in the group’s governance. The mission of the stakeholder group is to achieve consensus on the ranked design criteria for hydrogen supplies (refer Steps 2 & 3). In the year 2027, the stakeholder group decides that a quadratic voting system works the best, with each member being given a 1000 micro-votes to find consensus on a wide range of topics (refer Step 3). The stakeholder surveys are conducted each year to produce the stakeholders’ preferred design criteria for hydrogen supplies. The results are made public, over the Internet, and for the energy companies to review.

In the year 2028, the stakeholder group develops a system for scoring energy companies (refer Step 4). The final scores are used to quantify the reward adjustments (r) and reward weightings (w) according to the policy for carbon rewards. The scoring system is implemented in 2031 to influence the energy companies that produce hydrogen fuels (refer Step 5).

After the stakeholder group calculates the reward adjustments for energy reliability (renergy), the rewarding authority then scales-up or scales-down all of these reward adjustments. This is to ensure that the reward adjustments are not too strong or too weak, otherwise they might undermine the reward market. The role of the rewarding authority is to ensure that the reward adjustments are just strong enough to influence the market without causing undue financial hardship for energy companies.

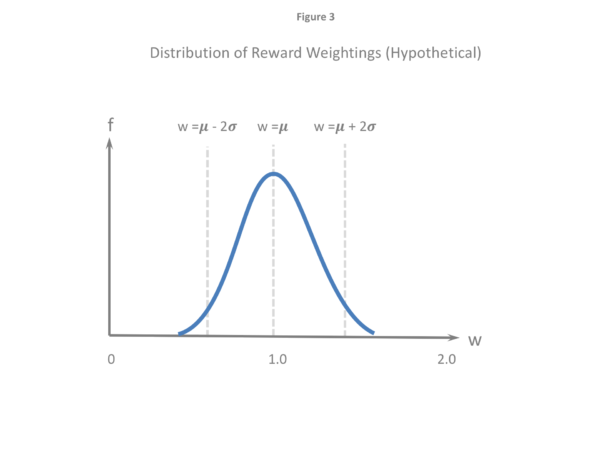

When the various reward adjustments for energy reliability, community wellbeing and ecosystem health are summed and then converted to reward weightings (w) they have a distribution like that shown in Figure 3 (refer Eq. 1 to 3 in Reward Weightings).

Figure 3.

In this hypothetical storyline for hydrogen fuels, the reward weightings (w) for energy companies are normally distributed. The distribution has a mean value close to 1.0 because the sum of the reward adjustments is zero. The rewarding authority has the option to increase/decrease the variance of the reward adjustments to strengthen/weaken the incentives for energy reliability, community wellbeing and ecosystem health (refer Eq. 1 to 3 in Reward Weightings).

By the year 2044, the hydrogen market evolves into two distinct markets for serving heavy and light industries. In 2045, the stakeholder group holds a general meeting and decides to split into two sub-groups: one for heavy industry, and one for light industry. The two sub-groups grow in popularity as they provide useful information to energy companies, investors and consumers. By the year 2050, the stakeholder group is instrumental in promoting a universal system of fittings, joints, and other connectors for providing hydrogen fuels for industry, heating, shipping, aeroplanes, trucks and other vehicles.