Cleaner Energy

Carbon Rewards

The reward for cleaner energy is a positive financial incentive for decarbonising the energy sector.

— Dr. Delton Chen (Founder)

The reward rule for cleaner energy is flexible enough that it can be applied in any energy market. The reward rule does not discriminate between private and state-owned energy companies, or between large and small companies, or between highly profitable and unprofitable companies. Participation in the policy by energy companies will be voluntary, however there will be two major reasons for energy companies to participate: (1) the financial reward, and (2) the moral imperative.

Here the term “cleaner energy” is used instead of the more conventional term “clean energy”. The reason is simply that all energy supplies have a carbon footprint. Renewable energy technologies typically have the smallest carbon footprint.

Despite recent advances in renewable energy technologies, many analysts have forecast that fossil fuels will remain a significant part of the global energy mix—even with an aggressive energy transition. This finding creates tension between people who propose that a rapid transition to 100% wind, water and solar (WWS) is feasible and necessary for most countries, and people who claim that we need to deploy carbon capture utilisation and storage (CCUS) because fossil fuels will remain a significant energy source for a long time to come. How should policymakers manage these complex tradeoffs? The “rule for cleaner energy” will invite markets to answer this question, as explained below.

What is the Global Carbon Reward?

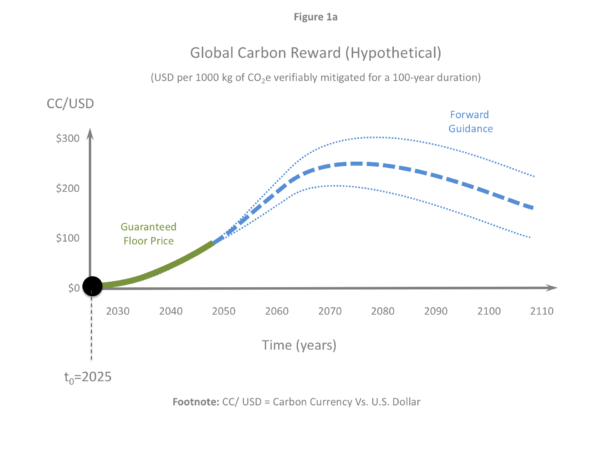

The economic value of the carbon reward is equal to the exchange rate of the carbon currency (CC). This exchange rate may be expressed in terms of any currency ‘pair’, as long as the carbon currency (CC) is set as the ‘base’ of the pair (e.g. CC/USD, CC/EUR, CC/CNY). Energy companies that wish to earn the reward should focus their attention on the future exchange rate of the carbon currency (see Figure 1) because this will be a primary factor in determining the economic value of the carbon reward. A second major factor in assessing the reward for cleaner energy is the carbon intensity of energy, which is explained below.

The rewarding authority will publish future CC/USD floor prices, like those shown in Figure 1 (a, b, c, d). The CC/USD charts in Figure 1 are only hypothetical examples to illustrate how the policy will work. The actual CC/USD exchange rates will fluctuate at above the floor price as a result of investor demand. The most important concept behind the CC/USD floor prices, is that they will be calibrated to achieve a specific climate objective (refer Carbon Currency & Pricing Theory).

The CC/USD charts in Figure 1 are analogous to the gold exchange standard of the Bretton Woods agreement. However the gold/USD exchange rate under the Bretton Woods agreement was fixed at US $35 per oz. of gold.

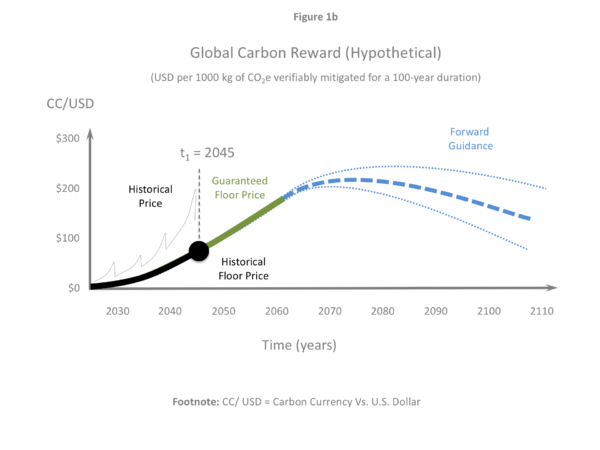

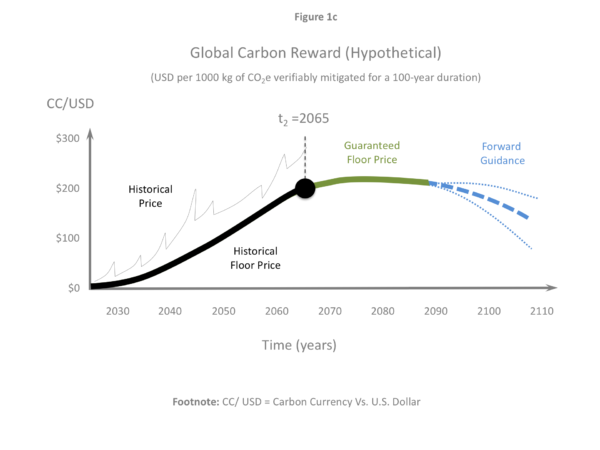

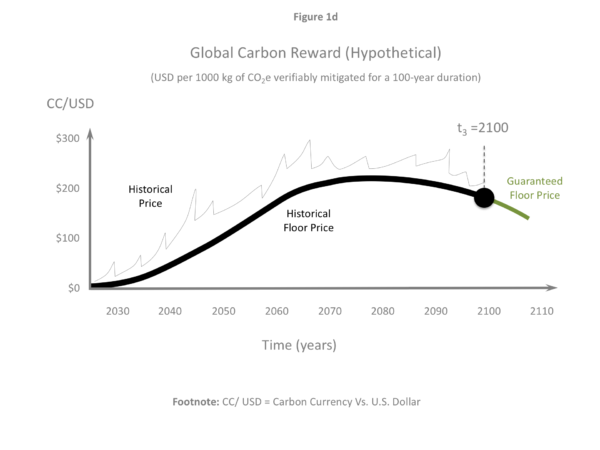

Figure 1 (a, b, c, d).

Hypothetical CC/USD Forex charts are shown as if they were being presented to the marketplace in the years (a) 2025, (b) 2045, (c) 2065 and (d) 2100. Note that the purpose of these CC/USD charts is to alert the marketplace of future exchange rates. They show a 20-year rolling period of guaranteed floor prices (solid green lines) followed by forward guidance for a rolling 80-year period (dashed blue lines). The USD is adopted as the ‘quote’ currency because it is the world’s reserve currency.

The CC/USD floor price in Figure 1 is guaranteed for 20 years into the future, as an example. The actual guarantee could be over a shorter or longer period. These guarantees are designed to encourage energy companies to make long-term financial plans to produce cleaner energy. These plans may involve high CAPEX investments and newly developed technologies, and so investors will need the assurance of the carbon reward in order to counterbalance the financial risks. The rewarding authority will adjust the floor price over the coming decades in response to emerging events, such as positive climate feedbacks and new technologies.

The floor prices in Figure 1 will guide investment decisions, but the actual CC/USD exchange rates will determine the market value of the reward payments for cleaner energy. The CC/USD exchange rate will vary in response to investor demand for the carbon currency (CC). It appears plausible that the CC will attract a great deal of investor demand because it will be underwritten by the world’s central banks, and because its value will rise according to predictable long-term trend.

The reward payments, when denominated in the carbon currency (CC), will be calculated as follows:

Rj = Δqj / Unit of Account

Base Reward for Cleaner Energy = Notional Mass of Mitigated Carbon / Unit of Account

(Eq. 1a)

The reward payments, when denominated in USD, will be calculated as follows:

Rj = CC/USD × Δqj

Base Reward for Cleaner Energy = Reward Price for Mitigated Carbon × Notional Mass of Mitigated Carbon

(Eq. 1b)

where Rj is the base reward for cleaner energy denominated in CC (see Eq. 1a) or in USD (see Eq. 1b); Δqj is the notional mass of mitigated carbon for the assessment period (t CO2e mitigated for a 100-year duration); and subscript j identifies the energy provider’s product (e.g. biofuel, methane gas, grid electricity).

The next step is to explain how the notional mass of mitigated carbon (Δqj) will be calculated using the proposed “reward rule for cleaner energy”.

What is the Rule for Cleaner Energy?

The carbon intensity (CI) of energy takes into account the carbon emissions that are created during the life-cycle of the energy product; and this includes fugitive emissions from infrastructure (e.g. uncapped wells, refineries, waste disposal sites). For solid, liquid and gas fuels—such as coal, oil, natural gas and biofuels—the carbon intensity (CI) includes the carbon that is emitted when all of the fuel is eventually combusted. Any carbon that is associated with carbon offset purchases, carbon dioxide removal (CDR) or direct air capture (DAC), is excluded from the carbon life-cycle analysis, and this is to ensure that the CI metric is representative of the energy supply itself [c].

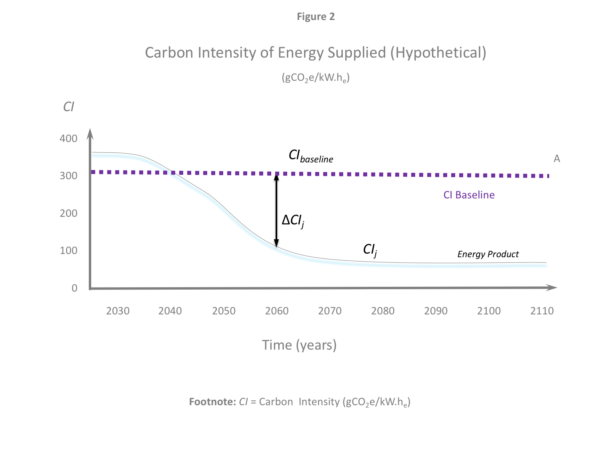

The ‘goal posts’ are defined by a carbon intensity baseline (CIbaseline) for each unique energy market. The carbon intensity baseline (CIbaseline) is a subjective quantity, and the rewarding authority will use empirical methods to determine a suitable CIbaseline for each energy market.

The rewarding authority will prescribe a carbon intensity baseline (CIbaseline) chart for each energy market in order to incentivise these markets to achieve a rapid and orderly rate of de-carbonisation. These CIbaseline charts will be comprised of a rolling period (about 10 to 20 years) of guaranteed CIbaseline values, followed by forward guidance on CIbaseline for an additional 80-90 years—and this is to synchronise the CIbaseline values with the carbon reward schedule shown in Figure 1. When setting the CIbaseline charts for each energy market, the rewarding authority will take into consideration the cost of conventional mitigation (e.g. electrification, efficiency gains), the cost of fuel substitution (e.g. algae oil, green methane), the cost of unconventional mitigation (e.g. CCS, CCU, CCSU), and hidden costs that might influence the decisions of energy companies (e.g. technological risks, regulations, price volatility).

The goals scored will be recorded as the difference between the carbon intensity baseline (CIbaseline) for the relevant energy market, and the carbon intensity of the energy products (CIj) that are actually traded in the marketplace. These goals are denoted as the difference in carbon intensity (ΔCIj) of the energy products over time, and averaged over the year. A notional mass of carbon emissions that has been avoided is then calculated from ΔCIj and the associated energy supplies (Ej) that are sold during each year:

Δqj = ΔCIj × Ej × 10-6

Δqj = (CIbaseline – CIj) × Ej × 10-6

Notional Mass of Mitigated Carbon = Difference in Carbon Intensity Relative to a Baseline × Energy Supplied

(Eq. 2)

where Δqj is the notional mass of mitigated carbon (tCO2e) ; CIj is the average carbon intensity of the product’s embodied energy (gCO2e/kW.he); Ej is the amount of energy product that is traded (kW.he); and subscript j identifies the energy producer’s product.

Figure 2

The carbon intensity baseline (CIbaseline) for a hypothetical energy market is compared with the carbon intensity of a single energy product (CIj). The difference in carbon intensity (ΔCIj) is used to calculate the notional mass of mitigated carbon (Δqj) (see Eq. 2) and the base carbon reward (Rj) (see Eq. 1). Note that the rewarding authority can adjust CIbaseline to influence the rate of de-carbonisation in each energy market (see Figure 3).

The mitigation of carbon emissions by energy companies can happen in two general ways: (1) with the conventional mitigation of point source and fugitive carbon emissions in the production supply-chain, and (2) with the substitution of fossil energy with cleaner or renewable equivalents. As mentioned above, the carbon intensity (CI) that is reported for each energy product is based on life-cycle analysis. For solid, liquid and gas fuels—such as coal, oil, natural gas, and biofuels—the CI is based on the assumption that the fuel is combusted under standard conditions, and that all of the volatile carbon is released to the atmosphere.

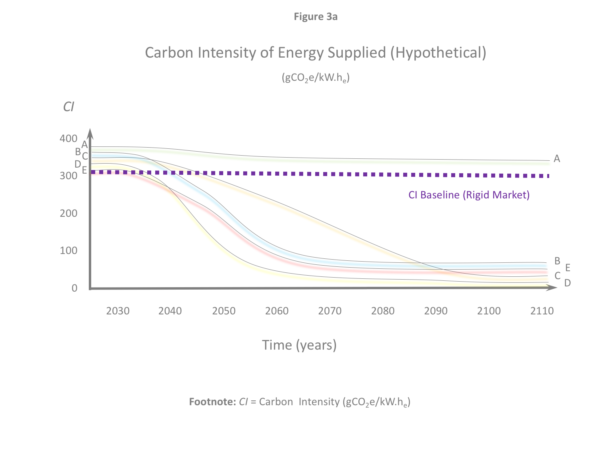

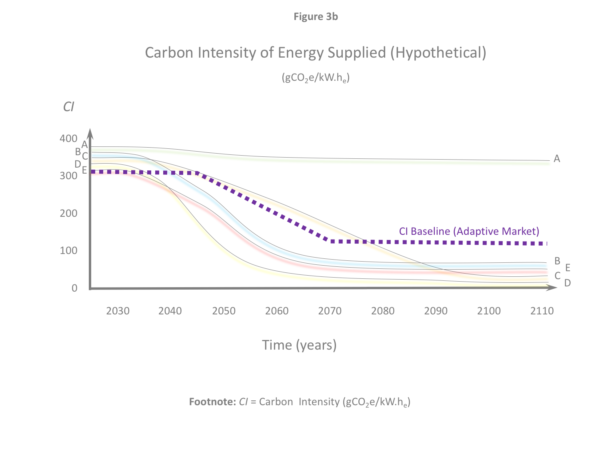

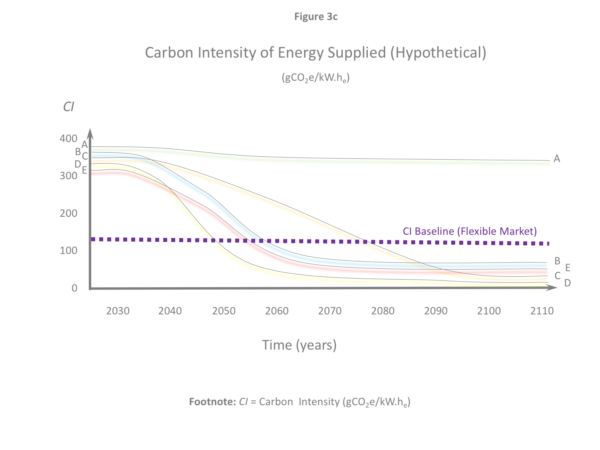

Figure 3 (a, b, c)

The carbon intensity (CI) of a hypothetical energy market is shown, including the prescribed carbon intensity baseline (CIbaseline) and the CI of five energy products (A, B, C, D and E). The energy company that supplies product A does not invest in de-carbonisation, whereas the energy companies that supply products B,C, D, and E earn carbon rewards for de-carbonising their products. Three hypothetical scenarios are shown: (a) a rigid market, (b) an adaptive market, and (c) a flexible market. The rewarding authority will adjust CIbaseline to ensure that the financial incentives are sufficient to trigger the de-carbonisation of the energy market.

Each energy market will be issued a carbon intensity baseline (CIbaseline) chart for a rolling 100-year planning period. The CIbaseline charts will be divided into a rolling 10-20 year (approx.) period of guaranteed CIbaseline values, followed by a 80-90 year (approx.) period of forward guidance on CIbaseline values. These CIbaseline charts will be used with the rolling 100-year carbon reward price chart (see Figure 1). The combination of the two kinds of chart (i.e. Figures 1 & 3) will give investors and planners an incentive and a compass for making major changes to the global energy supply network.

An important feature of the “reward rule for cleaner energy” is that the rewarding authority will be empowered to design the carbon intensity baseline (CIbaseline) chart for each energy market, with the aim of incentivising energy companies to undertake sufficient de-carbonisation. The hypothetical energy market in Figure 3(a) is “rigid” because the market resists de-carbonisation, and a relatively high CIbaseline is prescribed. The hypothetical energy market in Figure 3(b) is “adaptive” because it can be de-carbonised in stages with moderate investment, and so an adaptive CIbaseline is prescribed. The hypothetical energy market in Figure 3(c) is “flexible” because it can be de-carbonised with relatively modest incentives and investments, and so a low CIbaseline is prescribed. A hypothetical storyline for the de-carbonisation of the hydrogen fuels market is presented in the section on Energy Reliability.

Some energy companies may already be supplying energy that falls well below the CIbaseline in which case these companies may wish to earn the reward without changing their business models or energy supply networks. Given that the reward is designed to incentivise further decarbonisation, the rewarding authority will impose conditions on the reward offer to deter “rent seeking” behaviours. Rent seeking in this reward market will occur when energy companies try to earn rewards without providing a reciprocal contribution. To avoid rent seeking, the rewarding authority will require that energy companies implement plans for significant additional decarbonisation in order to be granted the opportunity to earn the carbon reward.

The “reward rule for cleaner energy” will guide the orderly de-carbonisation of the energy sector by incentivising cleaner energy supplies based on carbon life-cycle analysis. The various life-cycle analyses will take into account carbon capture and storage (CCS), carbon capture and utilisation (CCU), and leakage to the atmosphere [b]. The reward rule will not support carbon offset purchases, as these will be ignored [c]. Businesses that do not supply energy as their primary activity may be rewarded using the “rule for cleaner business“.

Carbon dioxide removal (CDR) and direct air capture (DAC) will only be included in the life-cycle analyses for energy companies if the carbon stocks and flows are integral to the energy supply chain. An example would be biofuel production. Biofuel production depends on photosynthesis by algae or vegetation, and so biofuel production is coupled to CDR. If energy companies undertake CDR or DAC that is decoupled from their energy supply chains, then this CDR or DAC will be ignored, however the CDR or DAC may qualify for rewards under the “rule for carbon removal“.

The reward policy will not account for the benefits of solar geo-engineering or solar radiation management (SRM); and it will not account for any weakening of the albedo cooling effect due to reductions in aerosol pollution [a,c]. SRM should be addressed using separate policies and governance structures that have yet to be defined.

What are the Key benefits?

A guaranteed carbon reward—which is a reward that is pre-defined for 10 to 20 years into the future and on a rolling basis—will satisfy investors and lenders, thereby attracting the multi-billion dollar investments that are needed for large-scale energy decarbonisation (refer Figure 1). Energy companies will be able to post profits that can justify the additional risks of adopting new technologies and business models.

The “rule for cleaner energy” is designed to reward energy companies based on reductions in the carbon intensity (CI) of their energy products, and not on the absolute mass of carbon that is emitted. The logic of this approach is based on the idea that energy companies that can produce cleaner energy will be able to expand their market share because of the revenue from the carbon reward and because of increasing demand for sustainable energy supplies. From an economic perspective, the aim is to make cleaner energy less expensive, and to ‘squeeze’ dirty energy out of the marketplace. Furthermore, the carbon reward will create new political opportunities to introduce more stringent regulations and carbon taxes to manage the bad actors who may continue to pollute. This approach is explained in the Pricing Theory that is called the carbon pricing matrix.

The GCR policy will increase revenue and net earnings for many energy companies. The additional revenue will attract additional equity finance through development loans, private equity finance, and green bond and climate bond issuance. All of this finance will be linked to the anticipated mass of carbon that can be mitigated under the reward rules.

The reporting requirements for the GCR policy and the amount of carbon currency that will be earned by energy companies can be integrated into environmental, social and corporate sustainability (ESG) reporting. For this reason, the GCR policy will impart greater significance on ESG reporting. These same metrics can be used to improve the transparency of green bonds, climate bonds and other investments.

The international monetary policy that backs the carbon currency will provide additional liquidity for the world economy, and it will act as a highly-targeted green financial stimulus. The carbon currency will have a predictable rising value (see Figure 1), and it may improve the overall stability of the global financial system, and it may also help to improve energy security.

A hypothetical storyline for the de-carbonisation of the hydrogen market is presented here to help explain how the policy works.

Important Policy Note: The feasibility of green hydrogen to accelerate the clean energy transition is a politically contentious issue. This is also true for certain other technologies, such as carbon capture and storage (CCS) and direct air capture (DAC). The GCR does not subsidise the development of any energy technology. The GCR is a financial reward that will only be paid for tangible climate mitigation benefits, regardless of the type of energy or the technology that is used. In this respect, the GCR is technology agnostic. Energy companies will be required to raise the financial capital that they need to build the new infrastructure. The GCR helps these companies by providing a guaranteed revenue stream that can be used to justify the high cost of the infrastructure that will be needed for a clean energy transition.

Updated 1 May 2021

Footnotes

(i) Substituting dirty electricity with cleaner electricity (e.g. wind, water, sunlight, geothermal, nuclear, biofuels);

(ii) Substituting fossil fuels with cleaner fuels (e.g. green methane, algae based oil);

(iii) Substituting dirty H2 with green H2;

(iv) De-carbonising grid electricity with cleaner energy storage (e.g. batteries, gravity storage);

(v) Supplementing dirty energy systems with carbon capture and storage (CCS); and

(vi) Carbon capture and utilisation (CCU) if the carbon does not leak into the atmosphere based on life-cycle analysis

(i) Carbon offset purchases;

(ii) Carbon capture and utilisation (CCU) if the carbon leaks into the atmosphere based on life-cycle analysis;

(iii) Carbon dioxide removal (CDR) or direct air capture (DAC) that is decoupled (redirect to the “rule for carbon removal“);

(iv) Businesses that do not supply energy as their primary activity (redirect to the “rule for cleaner business“);

(v) Solar geo-engineering or solar radiation management (SRM); and

(vi) Loss of the albedo cooling effect with a reduction in aerosol pollution [a].