Carbon Currency

Money’s a matter of functions four. A Medium, a Measure, a Standard, a Store.

Contents

Introduction

For a more in-depth understanding of the new climate policy and the associated pricing theory, see the sections on Introduction, Carbon Rewards and Pricing Theory.

The carbon currency will establish a global price signal and enable wealth transfer for the rapid de-carbonisation of the world economy.

Carbon Currency

The main functions of the carbon currency are summarised in Table 1 below, and this is followed by a more detailed description in the section on Technical Background.

Table 1. Four Functions of the Carbon Currency (CC)

| Function [b] | Description |

| Unit of Account (Measure) | Each unit of carbon currency (CC) will represent 1 tonne of CO2e mitigated for a 100-year duration, and therefore the CC may be classified as a “representative currency”. The CC is also a market pricing instrument. |

| Medium of Exchange (Medium) | CC will not be a medium-of-exchange (i.e. it will not be legal tender in any country). It will be issued as an incentive, and will behave as a financial asset. |

| Store of Value (Store) | CC will function primarily as a store-of-value. The CC exchange rate will be semi-managed so that it exhibits a predictable lower value relative to a basket of hard currencies, called the “CC floor price”. The spot exchange rate of the CC will float above the CC floor price under the forces of supply and demand. This semi-managed exchange rate regime may be called a “crawling peg”, and it will involve the gradual appreciation of the CC floor price for about 50 years — when the cost of mitigation per tonne of carbon is expected to peak. After the first phase of rising CC exchange rates, the CC floor price will gradually depreciate over many decades as the cost of climate mitigation falls with time. National fiat currencies will continue to float relative to each other. The CC floor price will be managed under a new international monetary protocol, called Carbon Quantitative Easing (Carbon QE). |

| Social Agreement (Standard) | CC will be a tool for establishing a new social agreement, called the carbon exchange standard (see (i), (ii) and (iii) below). The carbon exchange standard will define the quality of the climate mitigation services that may be rewarded with CC, and it will determine the minimum economic value of the CC that is to be issued as the reward. |

| (i) Reward Price | The carbon reward price will be communicated as the CC exchange rate using any currency pair that is convenient for market participants (e.g. CC/USD, CC/EUR, CC/YEN). The CC exchange rate will be indicative of the gross reward for climate mitigation services. The net reward will calculated from the gross reward by adding or subtracting—as appropriate—reward adjustments that are used to incentivise better social and ecological outcomes for stakeholders, and by subtracting administrative fees and commissions for mitigation assessors. |

| (ii) Currency Supply | The supply of CC will increase when enterprises earn CC as a reward. CC issuance will be conditional and tied to individual long-lived service-level agreements, and these agreements will be used to articulate the conditions of the carbon exchange standard. The CC supply will equal the cumulative net mass of the greenhouse gases that are mitigated under the policy (i.e. the carbon stocktake) divided by the unit of account. The carbon stocktake will be subjective because it will be a function of prescribed emissions baselines and other variables that will be required as inputs into the assessment of emissions reductions and carbon dioxide removal. |

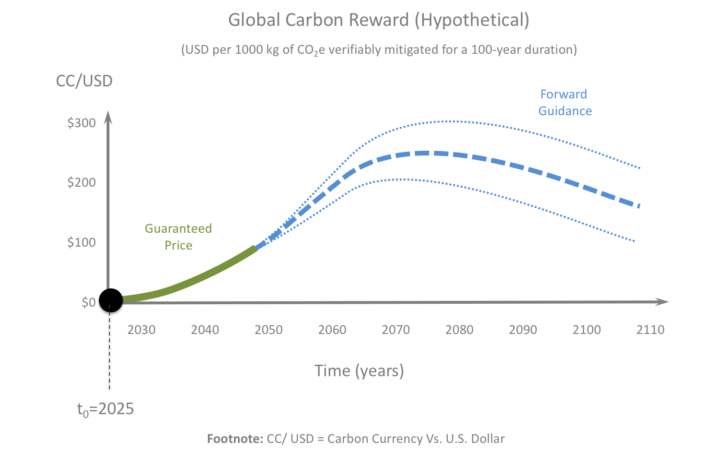

| (iii) Currency Demand | The demand for CC will be managed by a supranational authority that is mandated to implement the carbon exchange standard. The supranational authority will set a guaranteed minimum exchange rate (i.e. a floor price) for the CC over a rolling 10-20 year period approximately (see Figure 1). The supranational authority will also provide forward guidance for CC floor prices over an additional 80-90 years approximately to establish a rolling 100-year planning horizon for market participants. The supranational authority will ensure that the CC attains a value that is sufficient to achieve the main ambition of the 2015 Paris Climate Agreement, and the actual climate objective will be defined in terms of average mean surface temperature changes and their probability of occurrence. |

Technical Background

1. Currency Name

Table 2. Currency Name Translations

| Language | Translation |

| English Mandarin Chinese Hindi Spanish French Standard Arabic Bengali Russian |

carbon currency tàn huòbì — 碳货币 kaarban mudra — कार्बन मुद्रा moneda de carbono monnaie carbone eumlat alkarbun — عملة الكربون kārbana mudrā — কার্বন মুদ্রা uglerodnaya valyuta — углеродная валюта |

2. Unit of Account

Unit of Account = 1 tonne of CO2e mitigated for a 100-year duration

The “1 tonne of CO2e” is a commonly used standard mass in the measurement of greenhouse gases and when adjusting for their relative impact on the Earth’s energy balance, called the Global Warming Potential (GWP). The “100-year duration” is a commonly used length of time for assessing the GWP of greenhouse gases. Moreover, the “100-year duration” corresponds to the period of time that the mitigated carbon will be monitored (under the policy) to ensure that carbon leakage is taken into account. The service-level agreements for the recipients of the carbon currency will include conditions for taking into account the effects of carbon leakage. These conditions are necessary because the aggregate of all of the service-level agreements will be used to establish physical correlation between the supply of the carbon currency and the anticipated climate benefit at the global scale.

It is important to appreciate that the mass of carbon emissions that has been reduced is a subjective quantity. This is an inherent feature of emissions reductions, and it is a result of the fact that an emissions baseline must be prescribed for each project that claims to have reduced its carbon emissions. The assessment of the removal of greenhouse gases from the ambient atmosphere is not subjective, but it has other challenges that typically relate to its relatively high cost and the risk of carbon leakage.

A point of clarification is that the carbon reward will not be used to incentivise increases in surface albedo or the application of solar radiation management (SRM) technologies (refer the Biophysical Model for advice on SRM). The carbon reward will only be offered for reductions in carbon emissions with (1) cleaner energy supplies and (2) cleaner business practices, and for the removal of carbon from the ambient atmosphere by (3) carbon dioxide removal (CDR) (also called direct air capture).

3. Medium of Exchange

Medium of Exchange = a digital record of a financial asset that is not legal tender

4. Store of Value

Any currency pair may be used to communicate the market value of the carbon currency. On this website, the value is expressed in terms of the United States dollar (USD) because the USD is currently the world reserve currency. The carbon currency (CC) versus USD exchange rate is represented as “CC/USD”, which is the conventional way to articulate a currency pair in FX markets. The carbon currency (CC) is the “base” of the currency pair, and the USD is the “quote” of the currency pair. Note that the “/” symbol is not being used as a mathematical expression.

CC/USD = amount of USD that has the same market value as one unit of CC

5. Social Agreement

To put the carbon exchange standard into a more contemporary context, consider that (a) the carbon currency will not be loaned into existence, and (b) the carbon currency will be issued as a debt-free reward payment with service-level conditions. The time value of money is traditionally viewed in terms of interest on loans and yields on investments. Given that national fiat currencies are typically loaned into existence by commercial banks, the time value of fiat currencies is conventionally understood in terms of interest rates. The time value of the carbon currency is unconventional because it will be synonymous with climate mitigation services that are managed in accord with the carbon exchange standard. These points are explained below in the sections that cover (6) reward price, (7) currency supply, and (8) currency demand (see Pricing Theory for more details).

6. Reward Price

A convenient feature of the reward price for mitigated carbon, is that the reward is equivalent to the exchange rate for the carbon currency. For example, the reward price may be expressed in terms of the CC/USD exchange rate in markets that prefer to trade in USD:

Reward Price for Mitigated Carbon in USD = CC/USD

The carbon reward may be denominated in any national currency, for example:

Reward Price for Mitigated Carbon in EUR = CC/EUR

Reward Price for Mitigated Carbon in YEN = CC/YEN

Reward Price for Mitigated Carbon in CNY = CC/CNY

Given that the unit of account of the carbon currency (CC) is 1 tonne (1000 kg) of CO2e mitigated for a 100-year duration, the above exchange rates can be expressed in terms of their equivalent physical units, as follows:

CC/USD = USD per 1 tCO2e mitigated for 100-year duration

CC/EUR = EUR per 1 tCO2e mitigated for 100-year duration

CC/YEN = YEN per 1 tCO2e mitigated for 100-year duration

CC/CNY = CNY per 1 tCO2e mitigated for 100-year duration

The above examples show that carbon reward prices may be expressed in terms of any national currency, simply by quoting the relevant currency pair. Also important, is that the exchange rate of the carbon currency will be listed in FX currency markets such that the carbon reward will be visible to the whole world. This feature of the carbon currency is appropriate when the intention is to create a global price signal for climate mitigation services.

The carbon reward that is advertised using currency exchange rates represents the gross reward that is offered to market participants. Enterprises will only earn a net reward, which is the gross reward less administrative fees and commissions, and adjusted for the Reward Weightings which take into account their positive and negative impacts on energy reliability, community wellbeing and ecosystem health.

7. Currency Supply

Carbon Currency Supply = Stocktake for Mitigated Carbon/Unit of Account

The mass of CO2e that will be mitigated through (1) cleaner energy production and through (2) cleaner business practices, will be subjective. This is because it will be necessary to define a subjective emissions baseline for each enterprise in order to evaluate their emissions reductions. The prescription of emissions baselines for each enterprise will be undertaken in such a way as to maximise the efficacy of the carbon reward.

The supply of the carbon currency will generally increase over time, but it can also decrease marginally whenever there is any carbon leakage from low-carbon projects, or when enterprises default on their service-level agreements. The policy administrator will manage the destruction of carbon currency when this is needed, and the destruction process will be carried out as chargebacks or as demurrage fees for the holders of the carbon currency.

The supply of the carbon currency will be a useful metric for macroeconomic management because it will tell us precisely how much carbon has been mitigated under the GCR policy.

8. Currency Demand

A supranational institution will be responsible for evaluating and implementing the 100-year floor price for the carbon currency, and to define the reward rules that are optimal for addressing the Paris Agreement. This supranational institution will be mandated to achieve a specific climate objective that will be based on temperature limits (e.g. remaining below 1.5°C or 2°C of global warming) and levels of certainty (e.g. 33% or 67% chance of success).

Ideally, all central banks will be coordinated by the supranational institution under the one monetary policy, but the approach can still work if only the central banks of the largest economies are involved (e.g. only G20 nations). There are also options for organising the policy into clubs of nations with their own unique carbon currencies. For reasons of brevity, it is assumed here that a single carbon currency will be implemented under the auspices of the UNFCCC.

The target value for the carbon reward is called the floor price. For more background on the floor price, see the Risk Cost of Carbon (RCC) in the section on Pricing Theory. The floor price is the lowest price that the carbon reward should attain in order to deliver the chosen climate mitigation objective. The floor price must be forecast/evaluated by taking into consideration the various socioeconomic and biophysical factors that influence the economy-climate system (e.g. abatement cost curves).

The floor price will be estimated for a rolling 100-year period. It will be comprised of a rolling 10-20 year period with guaranteed CC/USD exchange rates (i.e. guaranteed under monetary policy), followed by a rolling 80-90 year period with forward guidance on CC/USD exchange rates (i.e. not guaranteed but are likely to be needed). The market demand for the carbon currency will be established as follows:

Carbon Currency Demand = Function {Rolling 100-year floor price for the CC/USD currency pair}

The rolling 100-year floor price for the CC/USD exchange rate is not the actual CC/USD exchange rate, because the actual exchange rate can rise above the floor price if market demand for the carbon currency is relatively strong. If market demand for the carbon currency is relatively weak, then central banks will intervene in the market by purchasing the carbon currency to uphold the floor price. Central banks will fund the carbon currency (CC) purchases with additional fiat reserves that they will create via expansive monetary policy—called carbon quantitative easing (CQE). CQE is an unconventional type of quantitative easing because it is specifically aimed at limiting climate-related risks by directly funding climate mitigation.

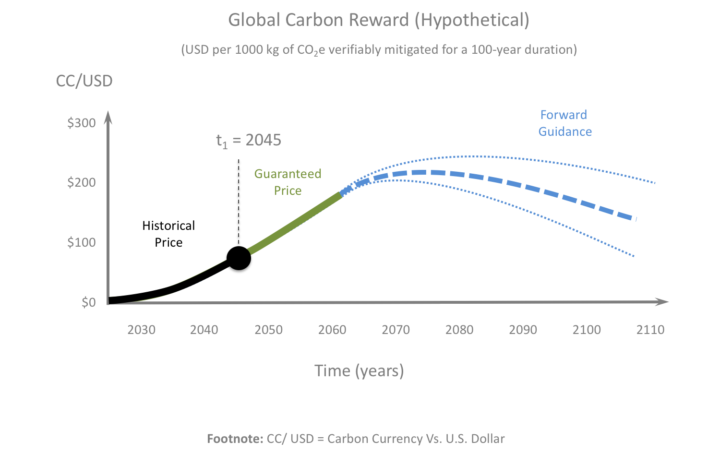

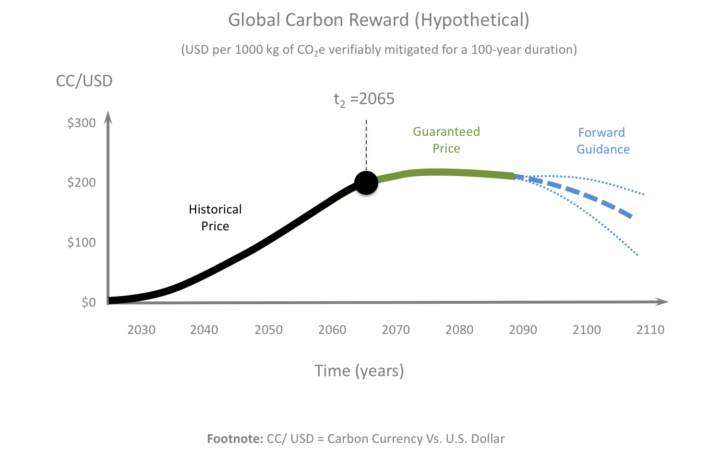

To understand the social dynamics of the rolling 100-year floor price, consider the hypothetical CC/USD chart shown in Figure 1. The starting time in the hypothetical CC/USD chart is denoted as t0, such that market actors are being given a CC/USD guarantee for a rolling 20-year period (i.e. guaranteed by central banks). Beyond the rolling 20-year period of guaranteed prices is a rolling 80-year period of forward guidance on the CC/USD. Forward guidance is conventionally given by central banks with regards to the direction of interest rates. In this case, the forward guidance is for the CC/USD exchange rate in order to encourage markets to plan for the orderly decarbonisation of the economy. This planning may involve high CapEx infrastructure projects—such as renewable energy projects, low-carbon industrial processes, low-carbon transport networks, and carbon dioxide removal (CDR)—and high OpEx projects that are labour and data intensive—such as carbon farming, regenerative agriculture, blue carbon and new business models based on lifestyle changes.

Figure 1 (a, b, c). Hypothetical rolling 100-year floor price chart for the carbon reward.

The hypothetical floor prices in Figure 1 are presented for the years (a) 2025, (b) 2045 and (c) 2065 to illustrate how market participants will be alerted to the reward incentive over the long-term. These charts include a rolling 20-year period of guaranteed reward prices (solid green lines), followed by a rolling 80-year period of forward guidance extending beyond the year 2100 (dashed blue lines). The floor price is expressed in terms of the CC/USD currency pair however a basket of currencies may be involved in the evaluation of the floor price.

Referring to the rolling 20-year floor price guarantee in Figure 1, when central banks purchase the carbon currency to underwrite the guarantee, these central banks will swap some of their national fiat currency for carbon currency, and they will accumulate carbon currency in their balance sheets. All central banks—not just the U.S. Federal Reserve—will be requested to undertake these currency swaps so that the monetary inflation can be spread as evenly as possible across the global financial system. The ideal allocation of currency purchases among central banks will be based on the relative size of each nation’s economy. This is to achieve benign monetary inflation and international equity based on the preventative insurance principle.

The rolling 100-year floor price chart will have three major impacts on the zeitgeist [c]: (1) it will communicate a new global price signal for incentivising an unprecedented amount of climate mitigation services, (2) it will communicate a multi-decade period of carbon currency appreciation for investors and currency traders, and (3) it will—if successful—communicate a post-crisis period based on falling climate-related risks and carbon currency depreciation.