Introduction

The GCR will be issued as a carbon currency, and the currency will be backed by central banks and monetary policy. A unique feature of the carbon currency is that it will be bankable, debt-free, and characterised by long-term value appreciation. Although the carbon currency will be a tradable asset, it will not be used as legal tender, and it will not be used to offset carbon emissions.

The GCR is explained in terms of ‘carrot and stick’ incentives and a new pricing theory for carbon. The value of the carbon reward—otherwise called the price for mitigated carbon—will equal the exchange rate of the carbon currency. This exchange rate will be managed to target a specific climate objective—such as 2.0°C with a 67% chance of success—for example.

The GCR policy is designed as a set of causal mechanisms that will enhance its effectiveness. The most important causal mechanisms are summarised below, including its integration with other policies in a ‘carrot and stick’ approach.

Carbon Mitigating, Not Offsetting

The carbon reward will be offered for reductions in carbon emissions at the source of the emissions, and for removing carbon from the ambient atmosphere. Carbon offsetting is not featured in the policy for carbon rewards, because it is not needed.

Carbon Assets, Not Offsets

The carbon currency will be a financial asset, because it will be an investment-grade currency backed by central banks. The carbon currency will not function as a carbon offset, and it will not function as legal tender. Trading the carbon currency will only result in a transfer of wealth between buyers and sellers.

Three Reward Rules

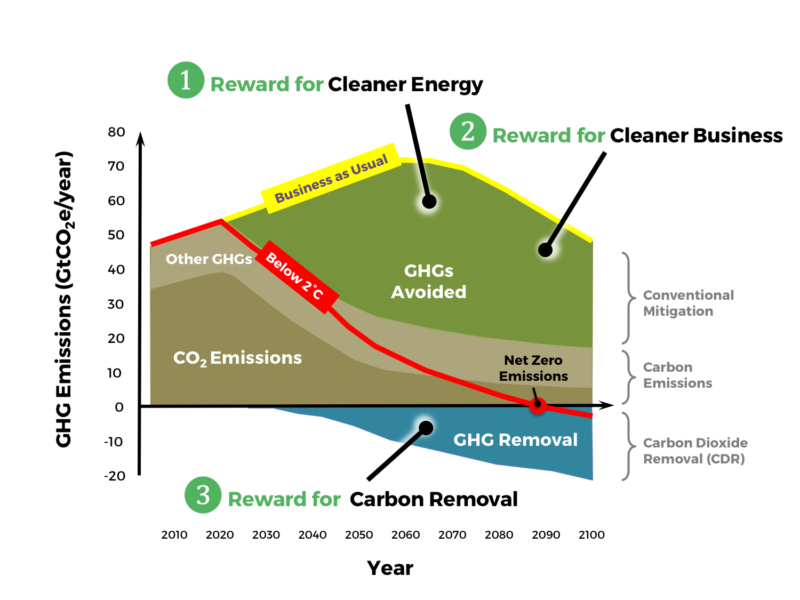

The GCR policy presents three options for earning carbon rewards: (1) by producing cleaner energy, (2) by developing a cleaner business, and (3) by undertaking carbon removal. Greenhouse gas (GHG) removal is included in the reward policy because residual carbon emissions are expected to be significant throughout the 21st century even though taxes and regulations may be strengthened (see Figure 1).

Adapted from UNEP (2017). The Emissions Gap Report 2017. United Nations Environment Programme (UNEP), Nairobi

Figure 1. Greenhouse emissions scenario for remaining below 2°C with a 67% chance of success

Carbon Rewards

This website introduces the new policy in a section on carbon rewards. The economic theory is introduced in a section on the carbon currency and pricing theory. Some visionary ideas emerge with the new policy, including the preventative insurance principle, and the notions of balanced growth in carbon and regenerative capitalism. Advice on how the reward rules should be applied is provided via the following three links.

Footnote: ‘optimal growth’ was replaced with ‘balanced growth in carbon’ for reasons of clarity (14 Feb 2024).

Reward Weightings

This website includes a section on reward weightings, which is a proposed governance model for supporting reliable energy supplies, community wellbeing, and ecosystem health. These reward weightings involve reward adjustments and a proposal for stakeholder groups. Advice on how the reward weightings may be determined is provided via the following three links.

Mitigation Technologies

An incomplete list of climate mitigation technologies that could earn the carbon reward is presented in Table 1. This list is divided into three groups to correspond to the three reward rules (refer Figure 1). A fourth rule for incentivising women’s education and family planning may be considered at a later date.

Table 1. Climate mitigation technologies that could potentially earn carbon rewards

| ❶ Reward for Cleaner Energy | ❷ Reward for Cleaner Business | ❸ Reward for Carbon Removal |

|

Examples ◼︎ Substituting coal- and gas-fired electricity with renewables |

Examples ◼︎ Reducing the carbon footprint of buildings and industry |

Examples ◼︎ Reforestation, afforestation and re-wilding |

Footnotes: (1) CCS = carbon capture and storage; CCU = carbon capture and utilisation; CCUS = carbon capture and utilisation and storage; CFC = chlorofluorocarbon; HCFC = hydrochlorofluorocarbon; HFC = hydrofluorocarbon. (2) A fourth reward rule may be proposed for improved family planning and womens’ education. (3) Changes in the surface albedo of the Earth, whether intentional or unintentional, are not included in the assessment of carbon rewards and this is because the policy objective is framed by the anthropogenic carbon balance and not by albedo. For a discussion of solar radiation management (SRM) see Biophysical Analysis.

Causal Mechanisms

The effectiveness of the GCR policy is enhanced with the integration of causal mechanisms in a causal chain. The various causal mechanisms are social, informational, financial and political. They include (1) the provision of performance-based grants for mitigation services, (2) the provision of decentralised data collection and a global database for evaluating mitigation technologies, (3) the transfer of the mitigation cost (roughly US $3-4 trillion/yr) into currency markets to avoid political conflict and to resolve financial bottlenecks, and (4) the tracking of individual service-level agreements to manage the global carbon stock take over the long-term. Furthermore, the policy will (5) be integrated with other market and non-market policies in a carrot and stick approach for maximising societal cooperation.