Carbon Currency

Money’s a matter of functions four. A Medium, a Measure, a Standard, a Store.

Contents

Introduction

The XCC is analogous to precious metal currencies that are traded in the Foreign Exchange (Forex) — including gold (XAU), silver (XAG), platinum (XPT) and palladium (XPD). The XCC will represent carbon dioxide equivalents that are strategically mitigated under long-term contracts between project owners and an authority that manages the XCC. Unlike precious metal currencies, the XCC will have a partially managed price through a central bank guarantee, called the XCC price floor.

For a more in-depth understanding of the new climate policy and the associated pricing theory, see the policy working paper (also refer the sections on Introduction, Carbon Rewards and Pricing Theory).

The carbon currency will establish a global price signal and enable wealth transfer for the rapid and orderly de-carbonisation of the world economy.

Carbon Currency (XCC)

The main functions of the carbon currency (XCC) are summarised in Table 1 below, and this is followed by a more detailed description in the section on Technical Background.

Table 1. Functions of the Carbon Currency (XCC)

| Function [b] | Description |

| Unit of Account (Measure) |

Each unit of carbon currency (XCC) will represent 1 tonne of CO2e strategically mitigated for 100 years or more. The term “strategically mitigated” refers to two kinds of mitigated mass: (1) direct air capture (DAC), which is also called carbon dioxide removal (CDR); and (2) conventional mitigation through emissions reductions or avoidance. This unit of account is designed so that the amount of XCC that is given to conventional mitigation projects can be customised to achieve cost-effective outcomes. The customisation of the XCC payments is achieved using an adjustment factor, R, which is based on the relative cost of two different mitigation methods, as explained below. Consider that the unit of account for the carbon currency (XCC) is as follows: 1 XCC = 1 tonne of CO2e strategically mitigated for 100 years or more where the mass that is strategically mitigated equals either: (1) the mass mitigated via DAC; or (2) the mass mitigated via conventional methods multiplied by R, where R equals the actual reward price offered for the conventional mitigation divided by the average reward price offered for DAC (as defined by the XCC price floor). For example, if 1 tCO2e mitigated via a conventional method requires US $150 of rewards, and the average price for DAC is US $100 per tCO2e, then the R value for the conventional methods is 1.5. If the conventional mitigation project avoids 300,000 tCO2e, then the mass of strategically mitigated carbon is 450,000 tCO2e because the R value is 1.50. The R value will vary between projects, and it may also vary with time. The above unit of account proposes that conventional mitigation which is more expensive than DAC (R>1) results in a greater amount of strategic mitigation. Conversely, conventional mitigation which is cheaper than DAC (R<1) results in a smaller amount of strategic mitigation. The term “strategic mitigation” therefore refers to the economic effort that we are willing to expend to achieve a mitigation outcome. |

| Medium of Exchange (Medium) | The XCC will not be used as a medium-of-exchange (i.e. it will not be legal tender in any country). It will be issued as an incentive, and will behave as a financial asset. |

| Store of Value (Store) | The XCC will function primarily as a store-of-value. The XCC exchange rate will be partially-managed so that it exhibits a predictable lower value relative to a basket of hard currencies, called the “XCC price floor”. The spot value of the XCC will float above the XCC price floor under the forces of supply and demand in the open market. |

| Social Agreement (Standard) |

The XCC is a market tool for establishing a new social agreement in terms of financing strategically important mitigation outcomes to achieve the Paris climate goals. This agreement may be called the carbon exchange standard (CES) (refer (i), (ii) and (iii) below). The CES will define which climate mitigation services and projects may be rewarded with XCC — and how and when. It will also define the minimum value of the XCC over time. This minimum value is called the XCC price floor. The general details of the CES will be determined through international negotiations and contextualised in terms of the systemic risks related to the carbon cycle. The precise technical details of the CES will evolve over time as the carbon exchange authority (CEA) adapts to changing circumstances and expands, tests, and refines the policy. |

| (i) Reward Price |

The carbon reward price will be communicated as the XCC spot price using any currency pair that is convenient for market participants (e.g. XCC/USD, XCC/EUR, XCC/YEN). The XCC spot price will be partially-managed with a “lower crawling peg”. This will involve a gradual rise in the XCC price floor for the first 50 years approximately — while the cost of DAC per tonne of CO2e needs to rise for stronger mitigation outcomes. The XCC price floor will then fall gradually — while the cost of DAC per tonne of CO2e falls as a result of technological progress. National fiat currencies may float relative to each other over time without adversely impacting the policy. The XCC price floor will be determined and managed under an international agreement for managing systemic risks. Central banks will be involved in executing this agreement. More specifically, central banks will undertake a program of strategic quantitative easing, called carbon quantitative easing (carbon-QE), to guarantee the XCC price floor (i.e. the lower crawling peg). |

| (ii) Currency Supply |

The total supply of XCC will increase when projects earn XCC as a reward. XCC issuance will be conditional and tied to long-lived service-level agreements and performance agreements. These agreements will be used to communicate the carbon exchange standard (CES) to awardees. Reward adjustments may be imposed under the CES — by adding or subtracting rewards — as a secondary incentive to encourage social and ecological co-benefits. However, the global sum of these reward adjustments shall always approach zero so that no XCC is created or destroyed through the reward adjustment mechanism. A certain percentage of the newly issued XCC will be given to the Carbon Exchange Authority (CEA) in order to fund the policy’s administration, the mitigation assessments, and policing. The sub-total of the XCC supply that is used to fund CDR/DAC may be used as a direct measure of CDR/DAC for projects, corporates, nations, and the world — and this is because 1 unit of XCC is issued for 1 tonne of CO2e that is removed from the atmosphere via CDR/DAC (refer Unit of Account). However, the total supply of the XCC cannot be used to index the global carbon stocktake because the XCC’s unit of account is actually based on “strategic mitigation” and not actual mass (refer Unit of Account). The raw data that are collected under the policy can be shared and used by other organisations to estimate the carbon stocktake for projects, corporates, nations, and the world. |

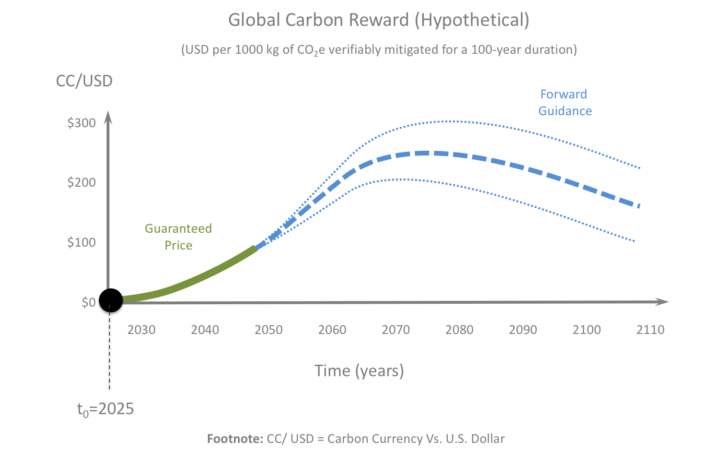

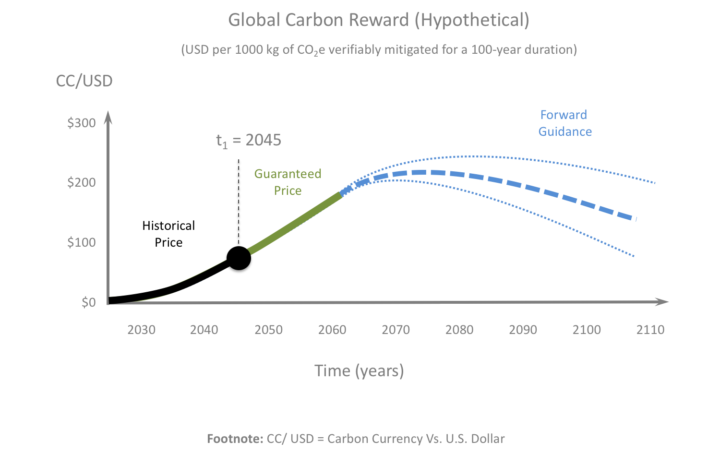

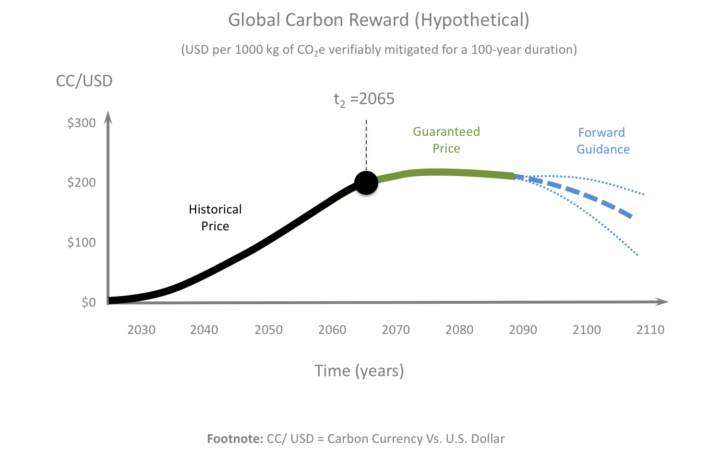

| (iii) Currency Demand | The market-generated demand for the XCC will be partially managed by a monetary board that will be appointed by the carbon exchange authority (CEA) to determine an XCC price floor that can achieve the main goals of the 2015 Paris Agreement. The monetary board will also be responsible for implementing this price floor. The XCC price floor will define the guaranteed minimum XCC/USD over a rolling 10-20 year period, and forward guidance on the minimum XCC/USD for an additional 80-90 years (see Figure 1). The XCC price floor will thus constitute a rolling 100-year planning horizon for markets. |

Technical Background

1. Currency Name

Table 2. Currency Name Translations

| Language | Translation |

| English Mandarin Chinese Hindi Spanish French Standard Arabic Bengali Russian |

carbon currency tàn huòbì — 碳货币 kaarban mudra — कार्बन मुद्रा moneda de carbono monnaie carbone eumlat alkarbun — عملة الكربون kārbana mudrā — কার্বন মুদ্রা uglerodnaya valyuta — углеродная валюта |

2. Unit of Account

1 XCC = 1 tonne of CO2e strategically mitigated for a 100-years or more

The term “strategically mitigated” refers to carbon that is removed from the ambient atmosphere using direct air capture (DAC), and carbon emissions that are reduced or avoided relative to a counterfactual baseline of emissions. However, the carbon emissions that are reduced or avoided are multiplied by a factor, R, which is the reward price that is paid for conventional mitigation divided by the average price paid for DAC, as defined by the XCC price floor. In other words,

strategic mitigation = DAC

and

strategic mitigation = conventional mitigation × R

where R is the ratio of two prices: the reward price paid for conventional mitigation divided by the reward price offered for DAC, as defined by the XCC price floor.

This adjustable unit of account implies that the amount of XCC that can be offered for conventional mitigation projects is not restricted by the XCC price floor because it can be increased (R>1) or decreased (R<1) to be more cost effective. The aim is to adjust the R for each project so that the aggregate of all of the conventional mitigation is sufficient to achieve the Paris goal. Overall, the XCC reward payments should be designed to provide mitigation outcomes that are (i) cost effective, (ii) technically feasible, and (iii) globally strategic.

For technical clarity it should be noted that “1 tonne of CO2e” is a commonly used standard mass in the measurement of greenhouse gases and when adjusting for their relative impact on the Earth’s energy balance, called the Global Warming Potential (GWP). The “100-year duration” is a commonly used length of time for assessing the GWP of greenhouse gases. Moreover, the “100-year duration” corresponds to the minimum period of time that the mitigated carbon will be monitored. The service-level agreements for awardees will include carbon accounting rules for addressing carbon leakage/loss.

It is important to appreciate that the mass of carbon emissions that has been reduced or avoided is a subjective quantity. This is an inherent feature of emissions reductions, and it is a result of the fact that a counter-factual emissions baseline must be prescribed for each project that claims to have reduced its carbon emissions. DAC projects, on the other hand, will have an emissions baseline of zero emissions.

Another point of clarification is that the XCC will not be used to incentivise increases in surface albedo or the application of solar radiation management (SRM) technologies (refer the Biophysical Model for advice on SRM).

3. Medium of Exchange

4. Store of Value

Any currency pair may be used to communicate the market value of the XCC. On this website, the XCC’s value is expressed in terms of the United States dollar (USD) because the USD is currently the world reserve currency. The XCC versus USD exchange rate is represented as the “XCC/USD” currency pair. The XCC is the “base” of the currency pair, and the USD is the “quote” of the currency pair. Note that the “/” symbol is not a mathematical expression.

5. Social Agreement

To put the CES into a more contemporary context, consider that (a) the XCC will not be loaned into existence, and (b) the XCC will be issued as a debt-free conditional grant. The time value of money is traditionally viewed in terms of interest on loans and yields on investments. Given that national fiat currencies are mostly loaned into existence by commercial banks, the time value of fiat currencies is conventionally understood in terms of interest rates. The time value of the XCC is unconventional because it will be synonymous with the long-term benefits of climate mitigation. These points are explained below and in the sections that cover (6) reward price, (7) currency supply, and (8) currency demand (see Pricing Theory for more details).

6. Reward Price

Reward Price = XCC/USD

Reward Price = XCC/EUR

Reward Price = XCC/YEN

Reward Price = XCC/CNY

Given that the unit of account of the XCC is 1 tonne (1000 kg) of CO2e strategically mitigated for 100 years or more, the above exchange rates can be expressed in terms of their equivalent physical units, as follows:

XCC/USD = USD per 1 tCO2e strategically mitigated for 100 years or more

XCC/EUR = EUR per 1 tCO2e strategically mitigated for 100 years or more

XCC/YEN = YEN per 1 tCO2e strategically mitigated for 100 years or more

XCC/CNY = CNY per 1 tCO2e strategically mitigated for 100 years or more

7. Currency Supply

XCC Supply = Σ tCO2e strategically mitigated for 100 years or more

The supply of the XCC to projects can be reversed if there is carbon leakage or project owners default on their agreements. The CEA will manage the destruction of XCC when this is needed to account for chargebacks. Projects may also be charged an administrative fee, and they may also be subject to Reward Weightings that are designed to incentivise co-benefits and disincentivise harms with regards to communities and ecosystems.

8. Currency Demand

The monetary board of the carbon exchange authority (CEA) will be responsible for defining and implementing the XCC price floor. The CEA will also develop the reward rules for each economic sector and industry. The CEA will be mandated to achieve an objective that will be based on global temperature limits (e.g. remaining below 1.5°C or 2°C of global warming) with specific levels of certainty (e.g. 33% or 67% chance of success).

Ideally, all central banks will be coordinated under the policy, but the policy can still work if the majority of the G20 are involved. Another option is to organise the policy into clubs of nations with their own unique carbon currencies.

The minimum guaranteed value for the XCC is called the price floor. For more background on this price floor, see the Risk Cost of Carbon (RCC) in the section on Pricing Theory. The price floor will be evaluated by taking into account the various technical and economic factors that influence the marginal cost of direct air capture (DAC). The price floor will be comprised of a 10-20 year guaranteed period (i.e. guaranteed under monetary policy) followed by a 80-90 year period of forward guidance (i.e. not guaranteed but is likely to be needed).

The market demand for the XCC will be established as follows:

XCC Demand = Function {XCC/USD price floor for a rolling 100-year planning horizon}

The XCC/USD spot price will rise above the price floor if market demand for the XCC is relatively strong. If market demand for the XCC is relatively weak, then the central banks will need to purchase the XCC in the Forex to uphold the spot price at the price floor. Central banks will fund their XCC purchases with bank reserves that they will create via expansive monetary policy — called carbon quantitative easing (carbon QE). Carbon QE is a strategic type of quantitative easing because it is aimed at limiting climate-related risks over the long-term.

To appreciate the social implications of the price floor, consider the hypothetical XCC/USD chart in Figure 1. The starting time in the XCC/USD chart is denoted as t0, such that central banks provide a guaranteed minimum XCC/USD for a rolling 20-year period. Beyond this 20-year period, a rolling 80-year period of forward guidance is provided. Forward guidance is conventionally given by central banks with regards to the direction of interest rates. In this case, the forward guidance on the XCC/USD is to encourage markets to plan ahead for decarbonisation. Careful planning is needed for high CapEx infrastructure projects — such as renewable energy projects, low-carbon industrial processes, low-carbon transport networks, and DAC projects — and high OpEx projects that are labour and data intensive — such as carbon farming, regenerative agriculture, blue carbon, and low-carbon lifestyle changes.

Figure 1 (a, b, c). Hypothetical price floor for the XCC.

The hypothetical price floor in Figure 1 is presented for the years (a) 2025, (b) 2045 and (c) 2065 to illustrate how market participants will be alerted to the reward over the long-term. These charts include a rolling 20-year period of guaranteed prices (solid green lines), followed by a rolling 80-year period of forward guidance extending beyond the year 2100 (dashed blue lines). The price floor is expressed in terms of the USD however a basket of currencies may be involved in the definition of the price floor.

Whenever central banks purchase the XCC to defend the price floor, they will first print new bank reserves to fund these purchases. The allocation of XCC purchases amongst the various central banks will be based on the relative size of each nation’s economy, and this is to achieve benign monetary inflation and international equity. The approach is justified by the preventative insurance principle. All central banks—not just the central banks of the G20 — will be asked to participate in this XCC purchase program so that the resulting monetary inflation is spread as evenly as possible across the world economy.

The XCC price floor will have three major impacts on the zeitgeist [c]: (1) it will be a global signal for incentivising climate mitigation services, (2) it will signal a multi-decade period of XCC appreciation for investors and currency traders, and (3) it will — in the later stages of a successful transition — signal a post-crisis period based on XCC depreciation and falling carbon-related risks.